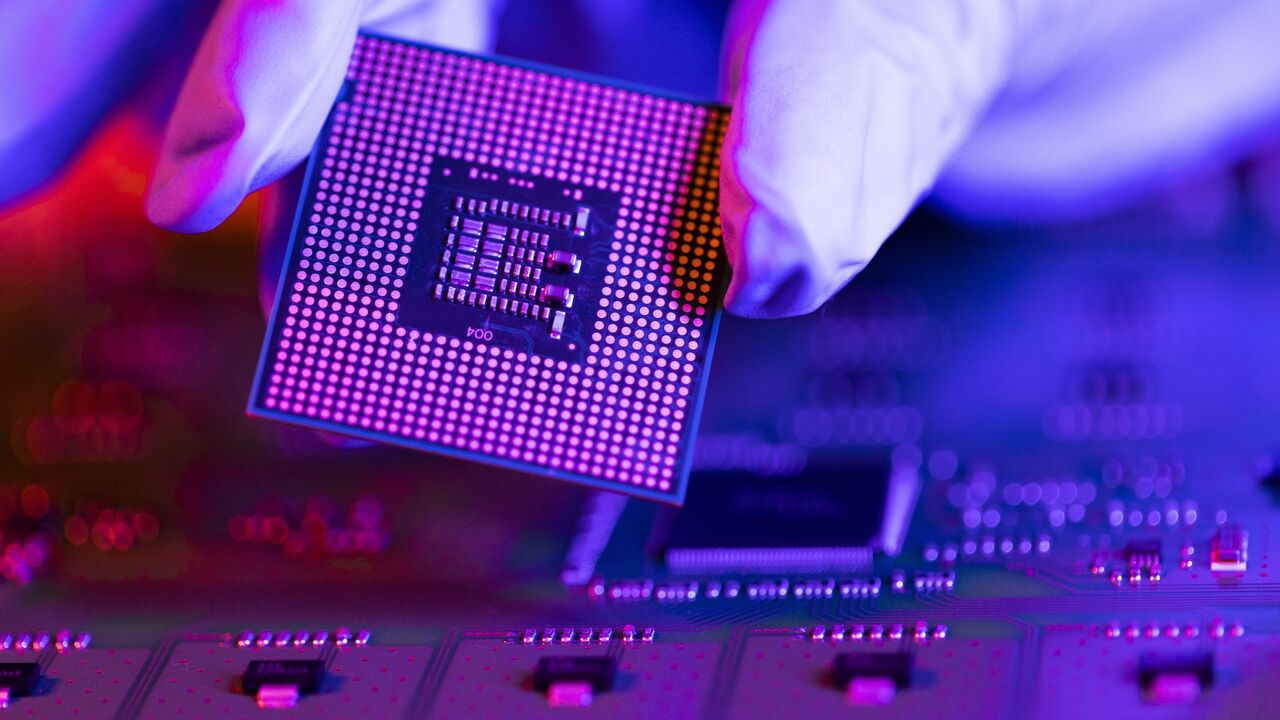

Israel’s Tower Semiconductor, Adani Group invest $10B in Indian microchip project

India is trying to position itself as a leading microchip producer, encouraging foreign companies to set up manufacturing facilities in the country.

Tower Semiconductor of Israel and the Indian Adani Group conglomerate will invest 839.47 billion rupees ($10 billion) in a semiconductor project in Western Maharashtra, the leader of the state said Thursday.

Chief Minister Eknath Shinde posted on the X platform that he had approved four major projects worth 1.17 trillion rupees ($14 billion) focusing on semiconductor and electric vehicle manufacturing.

The projects in Marathwada, Panvel, Pune and Vidarbha are expected to generate 29,000 jobs, Shinde said.

The Tower Semiconductor investment, included in the projects announced by Shinde, will see the Israeli company establish a facility in Panvel, in the Raigad district. It plans to divide the investment into two phases, IPF Online reported — 587.63 billion rupees ($7 billion) for the first phase, and 251.84 billion rupees (S3 billion) for the second phase.

Al-Monitor has contacted Tower Semiconductor for comment.

Tower Semiconductor, one of the largest microchip companies, has a market cap of around $4.6 billion.

India is currently trying to position itself as one of the biggest microchip producers by encouraging foreign companies to set up manufacturing facilities there.

In February, Prime Minister Narendra Modi approved $15.2 billion worth of investments for domestic semiconductor fabrication plants, including a proposal by the local conglomerate Tata Group to build the country's first major chip-making facility.

On a visit to Singapore this week, Modi signed a deal to strengthen microchip production in India in light of the southeast Asian nation's decades of experience in the sector. Singapore accounts for around 10% of global chipmaking output and some 20% of semiconductor manufacturing equipment production.

Despite moves by Modi to promote India’s microchip market, there have been some recent setbacks to the industry’s development on the subcontinent.

In July 2023, a $19.5 billion semiconductor joint venture between the Indian firm Vedanta and Foxconn fell through after the Taiwanese conglomerate pulled out of the deal.

ISMC, a joint venture of the Abu Dhabi-based Next Orbit Ventures and Tower Semiconductor to invest $3 billion in India, has been delayed.