US reportedly slows AI chip exports to Mideast as Saudi Arabia turns to China

Washington has further restricted imports of critical components for AI systems to certain countries, including some undisclosed ones in the Middle East.

The United States is reportedly slowing down artificial intelligence chip exports to Middle Eastern countries, including Saudi Arabia, where a state-linked fund announced it was investing in a Chinese rival to US company OpenAI.

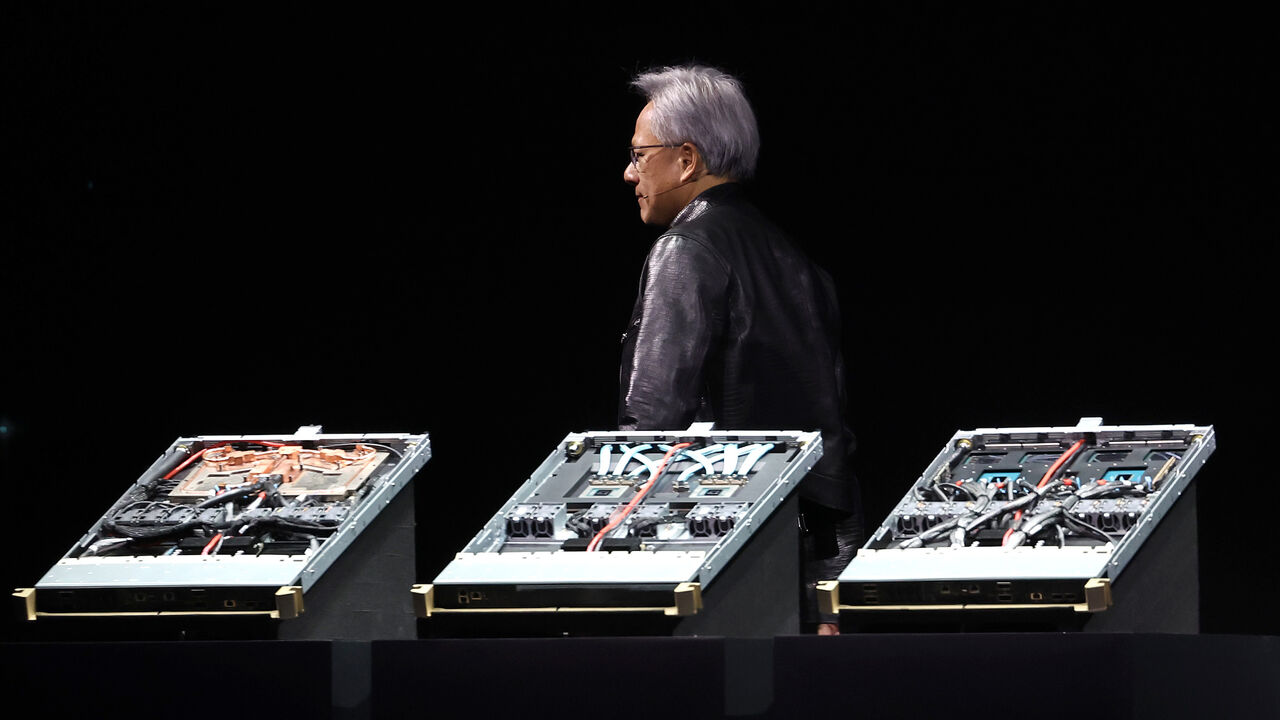

Bloomberg reported Friday, citing sources familiar with the matter, that US officials have slowed the issuing of licenses for AI accelerator shipments from chipmakers such as Nvidia Corp and Advanced Micro Device Inc. to the Middle East while the Biden administration conducts a national security review of AI development in the region. AI accelerators are data centers that process information needed to develop artificial intelligence chatbots and other tools. They are imperative for businesses and governments looking to build a digital infrastructure.

China and the United States have been battling to become the world's technology leader. Last year, Washington has been restricting imports of critical components for AI systems to certain countries, including some undisclosed ones in the Middle East, that use products from both of the world’s tech powerhouses. They include microchips made by California-based Nvidia and Advanced Micro Device Inc. used to train AI models. Also in 2023, the US government imposed limits on American investments in China.

Although Chinese relations with the United States and Europe have cooled, Beijing has been developing ties with several Gulf leaders in AI, including Saudi Arabia and the United Arab Emirates. On Thursday the Financial Times reported that a Saudi fund had invested in Zhipu AI, China’s answer to OpenAI’s ChatGPT chatbot.

Prosperity7, part of Saudi state-owned oil company Aramco’s venture capital arm, participated in a $400 million investment in the Chinese group, the newspaper reported, citing two sources familiar with the matter.

The deal values Zhipu AI at around $3 billion and Prosperity7 was a minority investor in the round, according to the sources.

It marks the first significant foreign investment in one of China’s leading four generative AI start-ups, which include Zhipu AI, Moonshot AI, MiniMax and 01.ai. Although foreign investors such as Softbank and Tiger Global have previously invested in Chinese surveillance AI, they have not invested in generative AI.

Speaking about the investment, a person close to the Prosperity7 told the Financial Times, “The Saudis don’t want Silicon Valley dominating this industry.”

Prosperity7’s parent company Aramco has heavily invested into China, especially in the realm of petrochemicals. China is also Aramco's largest customer and the top importer of Saudi Arabia’s crude oil.

Washington's China divestment drive

US restrictions have made it hard for China’s AI companies to raise international funding, and instead they have relied on domestic capital. For example, Chinese e-commerce giant Alibaba Group Holding Ltd. and Shenzhen-based technology firm Tencent Holdings Ltd. have previously invested in Zhipu AI. Moonshot AI is funded by Alibaba and venture capital firm Hongshan.

However, Washington has been pressuring different Middle Eastern officials and businesses to divest from China. For example, Abu Dhabi firm G42, the Middle East’s largest AI company, agreed to withdraw from all Chinese business at the behest of the Biden administration. In March 2023, G42 acquired a stake worth at least $100 million in ByteDance, the owner of social media platform TikTik that is headquartered in Beijing. This year G42 sold its stake.

The head of Saudi Arabia’s new investment fund for semiconductor and AI technology, Alat, said earlier this month that the fund would divest from China if it were asked to by the United States. Chief executive Amit Midhat told Bloomberg in an article published May 8 that Washington was the “number one partner” for Riyadh for AI, as well as chips and semiconductors.

Although Beijing is leading Washington in many tech sectors, a March study by think tank Marco Polo found that the United States is home to 60% of the world’s top AI institutions and has 57% of the sector’s elite talent, compared with China’s 12%.

Al-Monitor reported on Monday that Prince Alwaleed bin Talal, a high-profile Saudi investor, and his business Kingdom Holding Company invested in billionaire Elon Musk’s $24 billion startup xAI.