Saudi PIF signs deals worth up to $50B with six Chinese institutions

As one of the world’s largest sovereign wealth funds, the $925 billion Saudi PIF is already heavily invested in China.

Saudi Arabia’s sovereign wealth fund, the Public Investment Fund, has signed memoranda of understanding worth up to $50 billion with six Chinese financial institutions as the kingdom continues to deepen its business and economic ties with Beijing.

The agreements were signed with the Agricultural Bank of China, Bank of China, China Construction Bank, China Export & Credit Insurance Corp., Export-Import Bank of China and the Industrial and Commercial Bank of China, a statement from the $925 billion Saudi fund said Thursday.

The statement said the documents cover areas of cooperation such as encouraging two-way capital flows through debt and equity.

One of the PIF’s core missions is to support Saudi Arabian Crown Prince Mohammed bin Salman’s ambitious Vision 2030 plan to diversify the kingdom’s economy away from a reliance on oil by investing in other sectors such as clean energy, entertainment, sports and tourism.

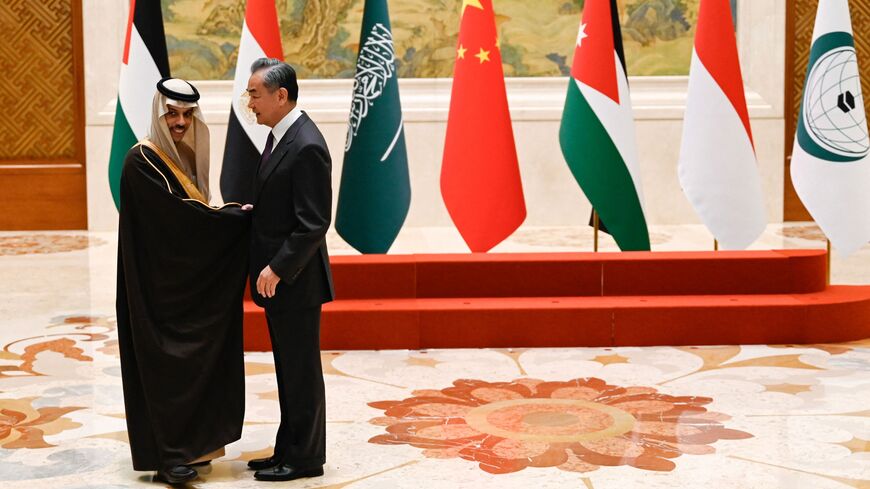

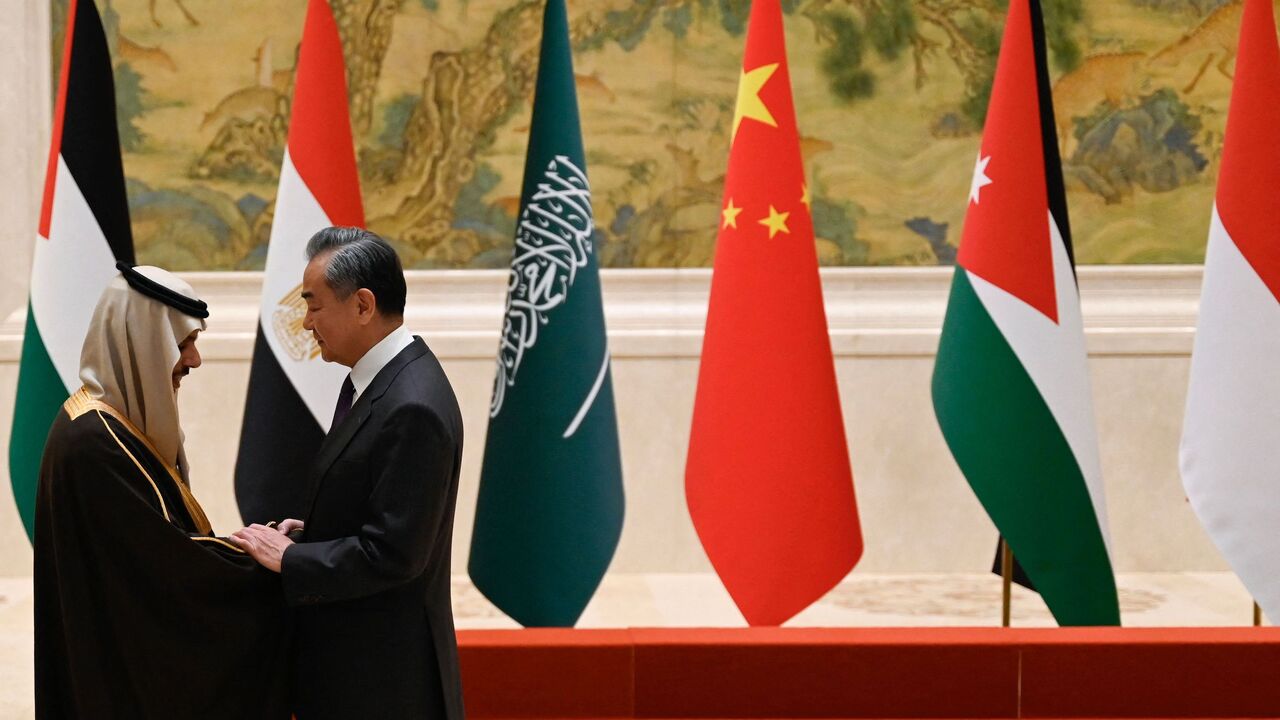

As one of the world’s largest sovereign wealth funds, the PIF is already heavily invested in China. Last month, Chinese Commerce Minister Wang Wentao said that China is willing to strengthen its development strategy with Saudi Arabia and increase its trade and investment with the country.

He made the remarks after holding talks with Yasir Al-Rumayyan, the head of affairs on Saudi Arabia’s economic cooperation with China, who is also the PIF’s governor and chairman of state-run oil firm Saudi Aramco. He is also a close confidant of Prince Mohammed. On that trip, Rumayyan led a large Saudi delegation and also met with China’s Vice Premier He Lifeng.

Although Saudi Arabia has strong ties with the United States, officials on Capitol Hill are increasingly wary of Riyadh’s growing cooperation with its rival superpower Beijing.

The energy ties between Beijing and Riyadh are particularly strong. China is Saudi Arabia’s biggest customer of crude oil and the two countries have heavily partnered in building factories and projects for other commodities, such as solar energy and petrochemicals. For example, on July 21, Saudi Aramco announced that it acquired a $3.4 billion stake in China’s Rongsheng Petrochemical Co. Ltd.

The PIF has also heavily invested in Chinese technology, including artificial intelligence. Alat, a PIF-owned investment firm established earlier this year, announced in February a joint venture with one of China’s biggest surveillance technology companies, Dahua Technology, that will develop its first overseas manufacturing facility in the kingdom. The same month, the PIF-owned Jafal Fund of Funds upped its investment eWTP Arabia Capital, a joint venture capital fund with China’s Alibaba that invests in energy and technology startups.